14.02.2020

SpaceX President Gwynne Shotwell says that the Starlink satellite internet business is in no rush to become a separate company and pursue an IPO, and that relaxed demeanor should terrify competitor constellations and ISPs like OneWeb and Comcast.

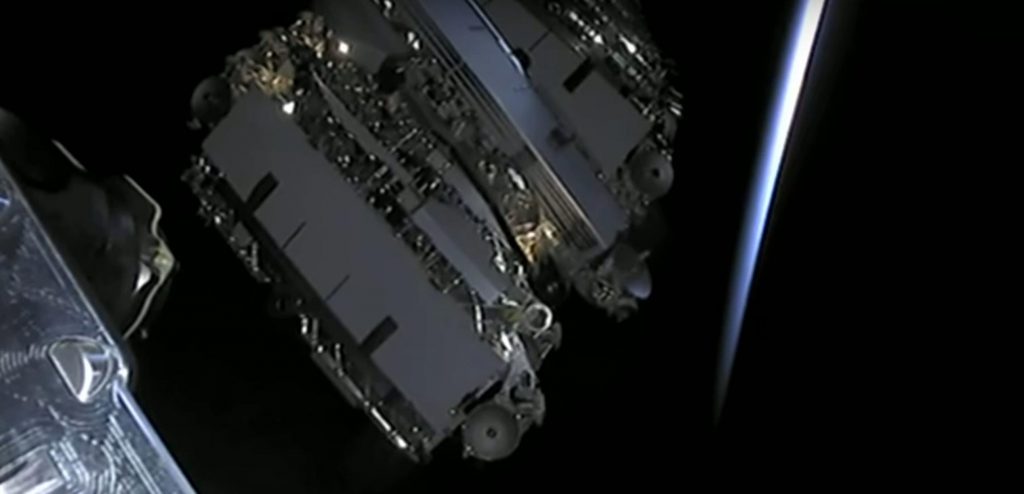

Announced in January 2015, SpaceX has been developing a massive constellation of satellites capable of delivering high-quality broadband internet anywhere on Earth for half a decade. Known as Starlink, SpaceX launched its first dedicated satellite prototypes – known as Tintin A and B – in February 2018, serving as a very successful alpha test for the myriad technologies the company would need to master to realize the constellation’s goals. 15 months later, SpaceX launched its first batch of 60 radically-redesigned Starlink satellites – packed flat to fit in an unmodified Falcon 9 payload fairing.

Less than nine months after that first ‘v0.9’ mission, SpaceX has completed another three dedicated launches and made Starlink – now some 235 operational satellites strong – the world’s largest private satellite constellation by a huge margin. Now just two days away from its fifth Starlink launch, SpaceX’s second-in-command has revealed that the company will likely split Starlink off into its own separate company, enabling an IPO without sacrificing SpaceX’s broader freedom. However, Shotwell also made it clear that SpaceX is in no rush to do so, and that fact should strike fear into the hearts of Starlink’s many potential competitors.

Bloomberg first broke the news with a snippet revealing that SpaceX COO and President Gwynne Shotwell had told a private investor event that Starlink could eventually IPO as an independent company. While undeniably important, a SpaceX source – after confirming the news – also told Reuters reporter Joey Roulette that it would be “several years” before the company might kick off the process of a Starlink IPO.

While a seemingly small piece of information at face value, the fact that SpaceX is years away from a potential Starlink IPO implies that the company is incredibly confident in where it stands today. Given that SpaceX only started ramping up its Starlink production rates and launch cadence a handful of months ago, that apparent confidence – assuming SpaceX’s respected President and COO isn’t lying to the faces of prospective investors – is no small feat.

Thanks to that production and launch cadence ramp, SpaceX is likely in the midst of one of the most capital-straining periods its Starlink program will ever experience. As a private company, SpaceX’s balance sheets are a black box to the public, but it’s safe to say that the it’s going through – or has already gone through – a phase of “production hell” similar to what Tesla experienced when it began building Roadsters, Model S/Xs, and Model 3s.

BUILDING SATELLITES LIKE CARS

In less than 12 months, SpaceX has effectively gone from manufacturing zero satellites to mass-producing something like 2-4 Starlink spacecraft every single day, almost without a doubt smashing any records previously held in the industry. It’s possible that companies like Planet (now the owner of the second-largest private constellation) or Spire have built more spacecraft in a given period, but SpaceX’s satellites are at least an order of magnitude larger, on average.

Around 260 kg (570 lb) apiece, SpaceX has built and launched a total of 240 spacecraft – together weighing more than 60 metric tons (135,000 lb) – in less than nine months. Furthermore, the company not only intends to crush that average but wants (if not needs) to do so for several years without interruption.

Back in May 2019, CEO Elon Musk confidently stated that he believes SpaceX already has all the capital it needs “to build an operational [Starlink] constellation”, likely referring to at least ~1500 operational communications satellites – launches included. This is why competitors should be moderately terrified that SpaceX isn’t even privately pushing for an IPO sooner than later. Perhaps the single biggest reason modern companies pursue IPOs is to raise substantial capital – usually far more than can be practically (or quickly) raised while private when executed successfully.

A step further, “several years” should mean titanic changes for SpaceX’s Starlink constellation if everything goes as planned. In 2020, SpaceX has publicly stated that it will attempt as many as 20-24 dedicated Starlink launches, an achievement that would translate to a constellation more than 1600 satellites strong by the end of the year. SpaceX says that 24 launches (20 if the first four missions are subtracted) is enough to offer global coverage and plans to begin serving customers in the northern US and Canada as early as this summer.

As of now, SpaceX has performed three 60-satellite Starlink launches total in the last three months – two in January 2020 alone – and Starlink V1 L4 (the fourth v1.0 launch and fifth launch overall) is scheduled to lift off just two days from now on February 15th. If Musk and Shotwell are correct and SpaceX can launch at least one or two thousand satellites without raising any additional capital, the constellation – potentially reaching those numbers by early to mid-2021 – may already have hundreds of thousands of customers by the time more funding is needed. 2000 Starlink v1.0 satellites, for reference, would theoretically offer enough collective bandwidth for more than 500,000 users to simultaneously stream Netflix content in 1080p.

As of early 2019, SpaceX had raised a total of $2B in venture capital, investments, and debt. Thus, even in the unlikely event that 100% of that funding goes to Starlink, the company would ultimately have to spend $500-700M annually from 2018 to the end of 2021 to run that large pool of capital dry by the time 1000-2000 satellites are in orbit.

500,000 customers paying $50-100 per month by the end of 2021 would conservatively allow Starlink to generate $300-600M in annual revenue, excluding the likely possibility of even more lucrative government or commercial contracts. In other words, if SpaceX can accumulate an average of 20,000 paying subscribers per month between now and the end of 2021, Starlink could very well become self-sustaining at its current rate of growth – or close to it – by the time SpaceX is hurting for more funding. In a worst-case scenario, it thus appears all but certain that “several years” from now, SpaceX’s Starlink program will have at least a few thousand high-performance satellites in orbit, an extensive network of ground stations, and a large swath of alpha or beta customers by the time IPO proceedings begin.

Given that all that potential infrastructure would easily be worth at least $1-2B purely from a capital investment standpoint, Starlink’s ultimate IPO valuation – under Shotwell’s patient “maybe one day” approach – could be stratospheric.

Quelle: TESLARATI